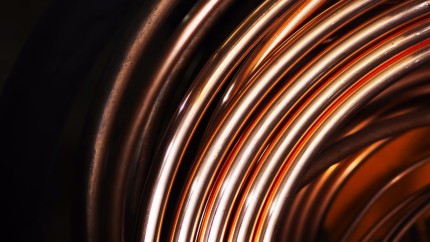

"Transparency enables agreement on what can be truly sustainably assessed. To create international standardization and thus comparability, that is the task of law and politics." With his keynote lecture, "How can financial markets be made sustainable? ", Prof. Dr. Wolf-Georg Ringe, from the Institute of Law and Economics at the University of Hamburg opened the 10th Capital Markets Conference. Ringe, who also holds a permanent visiting professorship at Oxford University, stressed that political trench warfare could undermine the credibility of taxonomy. Other experts from business and academia addressed the leading question of this year's conference, "Sustainability in Finance - Road to Success or Dead End?" in keynote speeches afterwards. Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, referred in his presentation "Financing Climate Sustainability - Harnessing Market Forces" to the short-term braking effect of Russia's invasion of Ukraine on the transition to climate neutrality: "This increases the pressure on the public sector," de la Rubia said. Overall, he said, while the performance of investment funds with a climate label has been disappointing, the potential for it is all the greater. In conversation, HCOB's chief economist contrasted only seemingly contradictory aspects: "How does the hugely energy-intensive production of refined copper fit into a sustainable world?" Better than you think, is the answer, because copper is one of the raw materials without which the energy transition is unthinkable: "Think, for example, of the power lines that are supposed to carry electricity away from the windy regions in the north to the industry-heavy south." In the light of Russia's invasion of Ukraine, the question of the sustainability of weapons production can also no longer be denied as a matter of course as it was a year ago, de la Rubia said.

And how has the very Ukraine conflict changed the preconditions for dovetailing financial markets and climate change goals now that priorities seem to be shifting toward solving the acute energy crisis? And does the taxonomy for ESG assets provide a starting point for engaging financial markets in achieving a carbon-neutral world? Following de la Rubia, these topics were also explored by the other experts, Rainer Verhoefen of Aurubis and Christian Otto of the Deutsche Bundesbank. In his keynote speech ""Sustainability as a criterion for the capital market", the CFO of Aurubis AG, Verhoefen, presented six new key performance indicators that underline Aurubis' ambitions in the area of sustainability. However, sustainability does not go without profitability, said Verhoefen. In his presentation, Christian Otto from the Deutsche Bundesbank also emphasized the challenges that the aspect of sustainability posed for the banking sector: "The supervisory requirements will continue to increase in the future." Sustainability risks would be successively integrated into the supervisory review and assessment process. "Without sustainability, there will be no sustainable business models and earnings at banks," Otto said.

More than 90 participants attended the 10th Capital Markets Conference in Hamburg to discuss the sustainable transformation of the financial sector against the backdrop of current geopolitical turmoil and economic developments. The panel discussion of experts in particular impressively demonstrated the many aspects of the transformation toward a financial sector that is more strongly characterized by sustainability.