May 2022 In the context of the interest rate benchmark reform reference rates are transitioned from IBORs to risk-free rates (RFRs). The reform is regarded as one of the most substantial changes in the financial market since the introduction of the Euro. Find out below what the reform is all about, how Hamburg Commercial Bank prepares for it and what it is means specifically for our clients.

Background

IBOR is the abbreviation for “Interbank Offered Rate”, i.e., the interest rates based on which banks lend money among each other in the interbank market. Besides, they serve as reference rates for a multitude of financial instruments – from variable loans over bonds and derivatives. IBORs vary with regards to currencies and tenors.

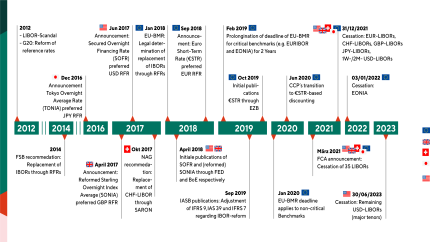

IBORs have been subject to critical scrutiny. Their calculation is not based on settled transaction, but on assessments of so-called panel banks, under which conditions money can be lend among each other. The lack of transparency of this process has rendered IBORs susceptible to manipulations and affected trust in the interbank market. In this context – and triggered through the so-called LIBOR-scandal in 2011 – the interest rate benchmark reform was initiated by the G20. Please find further information of the background of the IBOR reform in figure 1.

Figure 1: Historic summary of the interest rate benchmark reform

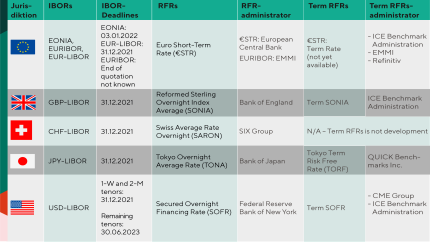

The interest rate benchmark reform is composed of several parallel initiatives of supranational committees (G20, FSB), central banks and representatives of the banking sector. The reform is supposed to develop and establish transparent and resilient reference rates to ensure the trust of market participants in the reference rates. The end of the old IBORs in the EU was legally decided in 2018 with the EU benchmark regulation (EU-BMR). Instead, alternative reference rates were developed and determined as a replacement, in particular the risk-free rates (RFRs). Figure 2 provides an overview of the most important reference rates, including the deadlines for the quotation of the IBORs and subsequent reference rates.

Figure 2: The most important reference rates globally

Methodological differences of the reference rates

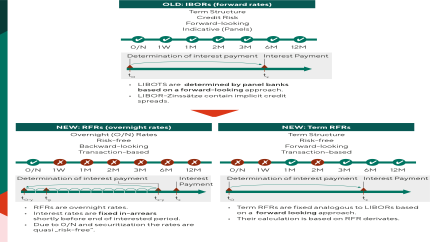

The fundamental difference between the old IBORs and the new RFRs: IBORs are term rates. They are determined by panel banks based on expert assessments of the development of the future interest rates in the interbank market.

In contrast, the new RFRs are overnight rates. They are determined based on real overnight transaction in the money market, e.g., based on institutional deposit transactions and collateralized repo transactions. Hence, payments of interest are not fixed at the beginning, but in-arrears in the end interest periods. Various compounding methods were developed to use RFRs for interest periods longer than overnight. Compared to IBORs, the RFRs reflect relatively low credit and liquidity risks, because they due to the short tenor and the high security of underlying transactions.

Alternative to the RFRs, there are Term RFRs, e.g., Term SOFR and Term SONIA. Those are derived from transactions of RFR-based derivatives. In contrast to RFRs and similar to IBORs they have a forward-looking term structure.

Figure 3 summarizes the essential differences in the methodology of IBORs, RFRs and Term RFRs.

Figure 3: The essential differences of the reference rates

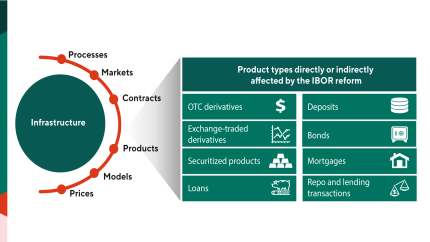

Comprehensive adjustments in HCOB’s technical infrastructure are required for the transition from IBORs to RFRs and Term RFRs, including processes, methods, and models. Besides, the existing IBOR-based contracts need to be transitioned to RFRs or Term RFRs.

Figure 4: Scope of the IBOR reform

Transition of legacy contracts

The quotations of IBORs gradually cease. As of end of 2021, 24 of the 35 LIBOR settings were ceased already.

- All tenors of the LIBORs for the currencies EUR and CHF;

- The tenors 1 week and 2 months of the USD-LIBOR;

- The tenors O/N, 1 week, 2 months and 12 months of the LIBORs for the currencies GBP and JPY.

Besides, as of the beginning of 2022 the quotation of EONIA was ceased.

The tenors 1, 3 and 6 months of GBP-/JPY-LIBORs are continued on a synthetic basis. However, they are not representative anymore. Their use is only allowed in exceptional (“tough legacy”) cases of legacy business. The quotation of synthetic LIBORs is temporary. The synthetic JPY-LIBOR tenors will probably be ceased by end of 2022. Also, the availability of the synthetic GBP-LIBOR tenors beyond 2022 is not warranted.

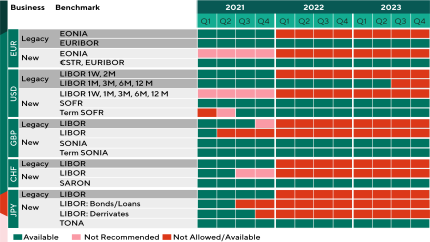

There is a prolonged deadline until mid-2023 for the remaining tenors of USD-LIBOR. For new business regulators across the currencies strongly recommend waiving the use of USD-LIBOR from 2022. As a result, the current focus of the interest rate benchmark reform lies on the transition of USD-LIBOR legacy business. Figure 5 summarizes the deadlines of the most essential IBORs and the availability of successive RFRs and Term RFRs.

Figure 5: Timeline of the transition of IBORs to RFRs and Term RFRs

Frictionless transition warranted for our clients

Hamburg Commercial Bank is well prepared to ensure a frictionless transition for our clients. HCOB’s IBOR-experts are actively involved in IBOR working groups in the banking sector. Thus, HCOB has a continuous exchange with other financial institutions and keeps an eye on relevant market developments.

Corresponding with the recommendations of respective IBOR working groups HCOB will transition the USD-LIBOR business until mid-2023 to RFRs or Term RFRs. Accompanied contract adjusted will be closely coordinated with our affected clients.

FAQ

What are IBORs?

IBORs (Interbank Offered Rates) are average interest rates based on which banks lend money among each other. The tenors range from overnight up to 12 months. IBORs work as reference rates for financial instruments that are linked to interest rates, e.g. derivatives, variable loans and bonds. As such they are of crucial importance in the financial market.

IBORs are respectively were available for various currencies. The most important IBORs are USD-/GBP- /EUR-/CHF-/JPY-LIBORs as well as EONIA and EURIBOR. The majority has already been ceased in the course of the interest rate benchmark reform (see below for details).

What is the interest rate benchmark reform?

The interest rate benchmark reform is described as the transition of reference rates from IBORs to alternative reference rates, in particular to the risk-free rates (RFRs).

What is the status quo of the interest rate benchmark reform?

We are currently in a phase of transition. Both, the old IBORs and the new RFRs are traded. The globally most important RFRs (SOFR, SONIA, €STR, SARON and TONA) were introduced. Besides, the EURIBOR was reformed based on the requirements of the EU benchmark regulation. At the same time, there are financial instruments based on the old IBORs.

However, the quotations of IBORs phase out. As of end of 2021 24 of the 35 LIBOR settings were ceased:

- All tenors of the LIBORs for the currencies EUR and CHF;

- The tenors 1 week and 2 months of the USD-LIBORs;

- The tenors O/N, 1 week, 2 months and 12 months of the LIBORs for the currencies GBP and JPY.

Besides, EONIA was ceased as of the beginning of 2022.

The tenors 1, 3 and 6 months of GBP-/JPY-LIBORs are continued on a synthetic basis. However, they are not representative anymore. Their use is allowed only for exceptional cases of existing legacy contracts (“tough legacy”). The quotation of synthetic LIBORs is temporary. The synthetic tenors of JPY-LIBOR will presumably be ceased by end of 2022. Also, the availability of the tenors of GBP-LIBOR is not warranted beyond 2022.

There is a prolonged deadline until mid-2023 for the remaining tenors of USD-LIBOR. For new business regulators across the currencies strongly recommend waiving the use of USD-LIBOR from 2022. As a result, the current focus of the interest rate benchmark reform lies on the transition of USD-LIBOR legacy business.

What happens to EURIBOR?

EURIBOR was reformed – its calculation is partly based on real transactions. It meets the requirements of the EU benchmark regulation and thus can be used. Yet it is currently unclear if EURIBOR will persist.

Why is the transition of IBOR contracts to risk-free rates (RFRs) required?

IBORs have been subject to critical scrutiny. Their calculation is not based on settled transaction, but on assessments of so-called panel banks, under which conditions money can be lend among each other. The lack of transparency of this process has rendered IBORs susceptible to manipulations and affected trust in the interbank market. In this context – and triggered through the so-called LIBOR-scandal in 2011 – the interest rate benchmark reform was initiated by the G20. The reform is supposed to develop and establish transparent and resilient reference rates to ensure the trust of market participants in the reference rates. The end of the old IBORs in the EU was legally decided in 2018 with the EU benchmark regulation (EU-BMR). Instead, alternative reference rates were developed and determined as a replacement, in particular the risk-free rates (RFRs).

How do RFRs differ from IBORs?

The fundamental difference between the old IBORs and the new RFRs: IBORs are term rates. They are determined by panel banks based on expert assessments of the development of the future interest rates in the interbank market.

In contrast, the new RFRs are overnight rates. They are determined based on real overnight transaction in the money market, e.g., based on institutional deposit transactions and collateralized repo transactions. Hence, payments of interest are not fixed at the beginning, but in-arrears in the end interest periods. Various compounding methods were developed to use RFRs for interest periods longer than overnight. Compared to IBORs, the RFRs reflect relatively low credit and liquidity risks, because they due to the short tenor and the high security of underlying transactions.

Alternative to the RFRs, there are Term RFRs, e.g., Term SOFR and Term SONIA. Those are derived from transactions of RFR-based derivatives. In contrast to RFRs and similar to IBORs they have a forward-looking term structure.

How can the difference between IBORs and RFRs be accounted for in the transition of existing legacy contracts?

Unlike RFRs the reference rate LIBOR includes bank-specific risk and term components. In contrast, RFRs are based on (nearly) risk-free overnight transactions. Hence, they include only minimal premiums for credit- and liquidity risks. To account for this economic difference the transition of legacy contracts from LIBOR to RFR should contain a credit adjustment spread (CAS). The credit adjustment spread corresponds to the premiums that are included in the LIBOR for credit and liquidity risks.

How long can IBORs still be used?

For any new business regulators across currencies recommend ceasing the use of LIBORs, including USD-LIBOR from 2022. In contrast, EURIBOR may still be used.

For legacy busines the quotations of IBORs gradually cease. As of end of 2021, 24 of the 35 LIBOR settings were ceased already.

- All tenors of the LIBORs for the currencies EUR and CHF;

- The tenors 1 week and 2 months of the USD-LIBOR;

- The tenors O/N, 1 week, 2 months and 12 months of the LIBORs for the currencies GBP and JPY.

Besides, as of the beginning of 2022 the quotation of EONIA was ceased.

The tenors 1, 3 and 6 months of GBP-/JPY-LIBORs are continued on a synthetic basis. However, they are not representative anymore. Their use is only allowed in exceptional (“tough legacy”) cases of legacy business. The quotation of synthetic LIBORs is temporary. The synthetic JPY-LIBOR tenors will probably be ceased by end of 2022. Also, the availability of the synthetic GBP-LIBOR tenors beyond 2022 is not warranted.

There is a prolonged deadline until mid-2023 for the remaining tenors of USD-LIBOR.

Contact:

Hamburg Commercial Bank will keep you up-to-date about the further development of the IBOR reform.

If you have any questions, feel free to contact us anytime at benchmark-reform@hcob-bank.com .

More information:

You can also find detailed information about the IBOR reform on the websites of the national IBOR working groups and industry organizations:

- ECB Working Group on Euro Risk-Free Rates , ECB working group

- Alternative Reference Rates Committee (ARRC) , Federal Reserve Board and New York Fed working group

- Working Group on Sterling Risk-Free Reference Rates , Bank of England working group

- National Working Group on Swiss Franc Reference Rates , Swiss National Bank working group

- Cross-Industry Committee on Japanese Yen Interest Rate Benchmarks , Bank of Japan working group

- International Swaps and Derivatives Association

- Financial Stability Board