The bank at a glance

Hamburg Commercial Bank – the specialist financier

Hamburg Commercial Bank (HCOB) is a private commercial bank and specialist financier headquartered in Hamburg, Germany. The bank offers its clients a high level of structuring expertise in the financing of commercial real estate projects with a focus on Germany as well as neighboring European countries. It also has a strong market position in international shipping. The bank is one of the pioneers in European-wide project financing for renewable energies and is also involved in the expansion of digital and other areas of important infrastructure. HCOB offers individual financing solutions for international corporate clients as well as a focused corporate client business in Germany. The Bank offers customized financing solutions for the global aviation sector as well as for national and international corporate clients. The bank’s portfolio is completed by digital products and services facilitating reliable, timely domestic and international payment transactions as well as for trade finance.

Hamburg Commercial Bank aligns its activities with established ESG (Environment, Social, and Governance) criteria and has anchored sustainability aspects in its business model. It supports its clients in their transition to a more sustainable future.

The bank’s specialists are as experienced as they are pragmatic. They act in a reliable manner and at eye level with their customers. They provide in-depth advice in order to jointly find efficient solutions that are a perfect fit – for complex projects in particular. Tailor-made financing, a high level of structuring and syndication expertise and many years of experience are just as much a hallmark of the bank as are our profound market and sector expertise.

Hamburg Commercial Bank had around 868 employees (full-time equivalents) as of 31 December, 2022 and total assets amounted of 31.8 billion euros.

Sustainability means future viability

Sustainability is just as important to Hamburg Commercial Bank as good financial results. It applies high ESG criteria to its own business activities and accompanies its clients on their way to a more sustainable future.

What Hamburg Commercial Bank stands for

As a specialist financier, Hamburg Commercial Bank closely supports its clients and does what it does best: It delivers tailoredsolutions that meet customers’ needs, ensures direct communication to facilitate timely decisions and offers efficient business processes to support its clients.

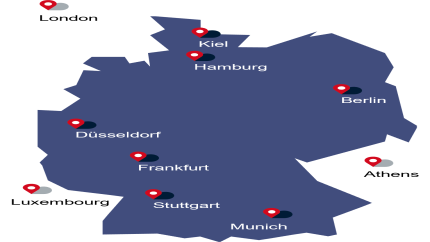

Hamburg Commercial Bank’s presence

Hamburg Commercial Bank Locations

Rating

Deposit Protection

The Bank is a member of the Compensation Scheme of German Banks (Entschädigungseinrichtung deutscher Banken GmbH). Further information is available at www.edb-banken.de .

In addition, the Bank participates in the Deposit Protection Fund of the Association of German Banks (Einlagensicherungsfonds des Bundesverband deutscher Banken e.V.). Further information is available under No. 20 of the Bank's General Terms and Conditions or at The Deposit protection scheme - Association of German Banks (bankenverband.de) .

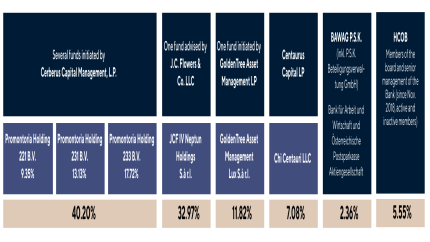

Shareholders

Hamburg Commercial Bank AG is the first privatized federal state bank (formerly HSH Nordbank AG) in Germany andhas had independent shareholders since November 28, 2018.

Percentages include rounding differences