Inka Klinger

Head of Project Finance

Alongside the financing of commercial real estate, ship financing, and the division Corporates Germany/Corporates International & Specialty Lending, project financing is one of Hamburg Commercial Bank’s core areas of expertise.

Infrastructure investments have been a particularly promising asset class for years. But they are also a class that requires particularly high knowledge not only on the part of investors but also from banks. Regulatory matters and the particularities of individual sub-markets have a substantial influence on assessment and structures. In short: Infrastructure is not banking business like any other.

Instead, it is a very important and very meaningful matter, as has been emphasized once again since the outbreak of the coronavirus pandemic. Traditional infrastructure investments in bridges, roads, and railways are now being outstripped by investments in renewable energies and digital infrastructure. Hamburg Commercial Bank has been one of the most committed and competent financial institutions in both fields for many years.

Both Germany and many other regions in Europe still hold vast expansion potential in relation to the development of renewable energies and digital infrastructure. The same applies for all topics relating to the subjects of the energy transition and decarbonization.

Yet even if the objective appears clear and transformation is necessary for the achievement of climate targets, the path to realization is often demanding. Projects in the areas of renewable energies and digital infrastructure require in-depth market knowledge, careful risk management, and qualified support throughout the entire project.

Hamburg Commercial Bank competently and actively advises, supports, and assists its clients.

Our teams offer you customized financing options and liquidity management, among other things. We also advise on options for hedging your risk.

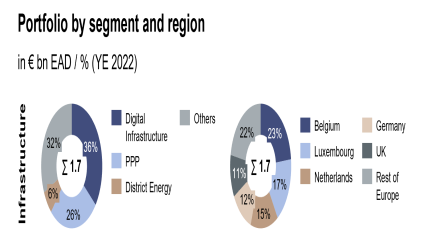

We have been involved in infrastructure projects since 1994. We are one of the top 15 infrastructure financiers in Europe. This position provides an incentive for us to offer our clients the best solutions. This also means that we are constantly evolving and are familiar with and help to shape trends in the industry. Numerous transactions testify to our successful involvement in the expansion of broadband networks in Europe, and particularly in our domestic market of Germany, and in the financing of data centers. Our experts are familiar with megatrends and help our clients to shape projects that advance the future.

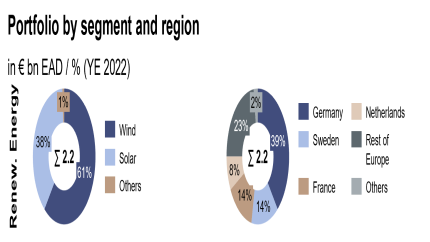

In the field of renewable energies, we are a successful pioneer. We are among the top financiers in Europe and have so far financed projects in the wind, solar, and hydropower asset classes throughout Europe.

We develop the optimal solution for financing your project together with you. Our teams combine the various instruments and put together a financing package that is right for you.

We have many years of experience in our core competencies. In renewable energy, we have mostly occupied the role of mandated lead arranger or have handled financing entirely as bilateral transactions.

We offer a wide range of services, from classic loans to complex structured financing with a high equity component. Optimal integration of program loans Our standard repertoire includes program loans, for example from KfW and the European Investment Bank or, if required, ECA cover (e.g. Euler-Hermes, EKF). We also support you with syndications.

Credit & Loans

We are the bank for your business and finance your projects quickly and bindingly. The final hold positions for new business, for example in renewable energy projects, are between 20 and 60 million euros. And if we can't handle your project on our own, we have no problem working with other banks and cooperation partners. Our claim: We find the best financing solution for you.

Structured financing

If project financing goes beyond mere lending, our experts structure your project creatively and solution-oriented. Our range of services extends from classic loans and equity-preserving hybrid products to equity solutions and syndications.

Corporate Finance

In addition to the classic financing services, our corporate finance know-how may also be of interest to you. For example, we can support you in your search for co-investors or in setting up a joint venture. And if a major acquisition or equity transaction is pending, our M&A experts will accompany you through the entire process - from the analysis of your options, preparation and individual structuring, through the search for and selection of the right partners, to the signing of the contract

Capital market, interest rate & foreign exchange management

At the interface between the credit and capital markets, we offer you a comprehensive range of products as well as fast and competent advice. We manage interest rate and currency risks for our customers with a wide range of the most common products. Our experts advise you and work with you to find the best solution for you.

More about Capital market, interest rate & foreign exchange management

Digital Services

We offer our customers a wide range of digital services that simplify the management of accounts and payment flows.

Account & Payments

The company account is the basis for a functioning payment transaction. We set up one or more accounts for you quickly and easily, which can be individually adapted to the needs of your project and also work internationally. In other words, we offer you optimum liquidity management and smooth international payment transactions. We control the KYC process digitally and are therefore very customer-friendly.

Come and talk to us, and see our expertise for yourself. Meet us directly at major trade fairs in the industry or at industry seminars.